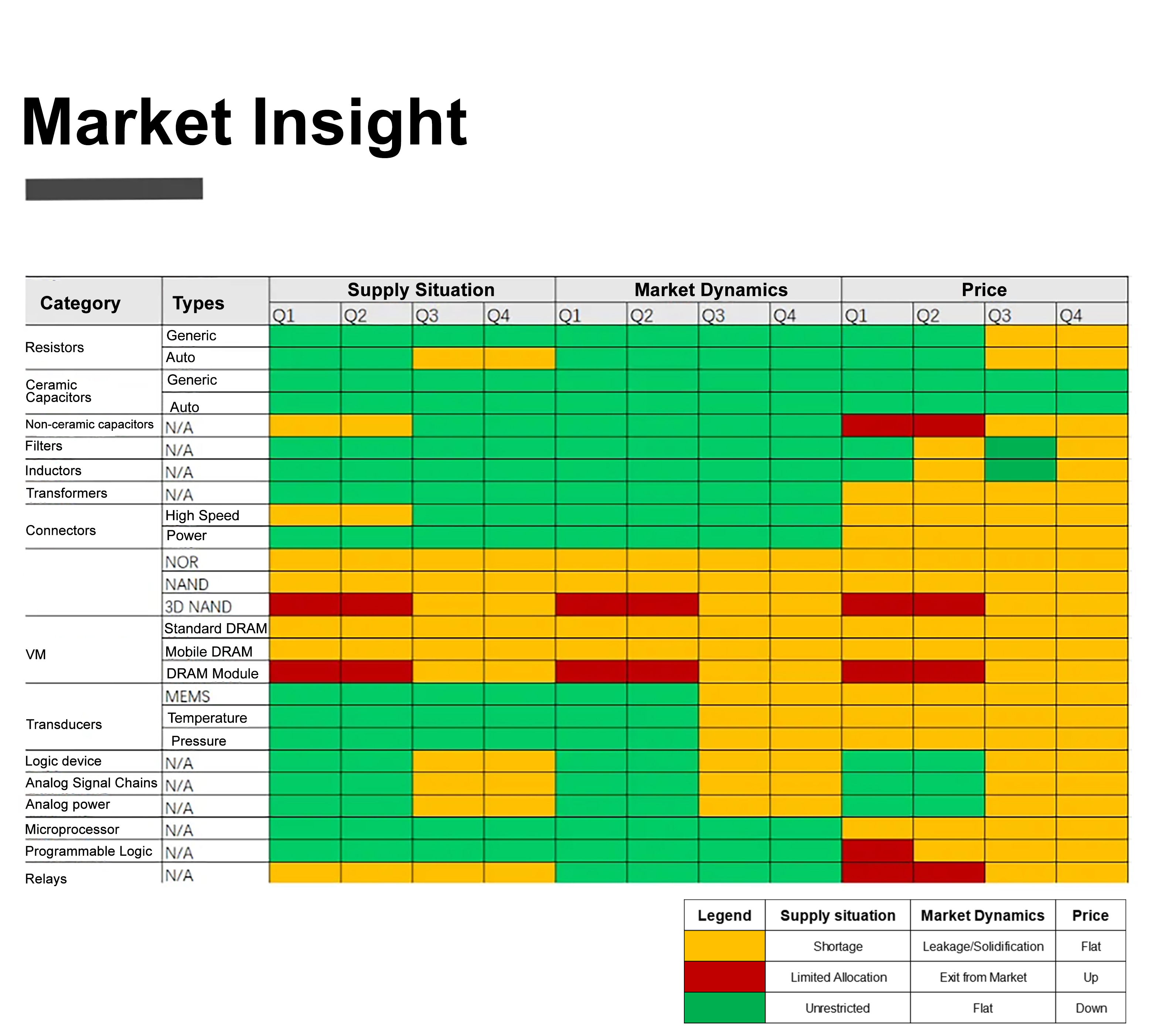

The latest export controls imposed by China and the U.S. on critical minerals and AI chips in late 2024 are casting a shadow over the stability of the global electronic component supply chain in 2025.

According to Supplyframe's Commodity Intelligence Quarterly (CIQ), most markets are expected to maintain supply-demand equilibrium except for memory products (DRAM, NAND flash including SSDs) and tantalum polymer capacitors.

Industry-wide inventory levels have normalized across the supply chain. However, with both passive and active component manufacturers scaling back production capacity, any unexpected demand surges or raw material shortages could rapidly extend lead times and create market-wide supply constraints.

Demand Trends

Arithmetic Circuits: Stable demand through Q1-Q3 2025, with a Q4 uptick. Businesses should closely monitor Q4 market shifts to adjust inventory and production.

Gate: Dual demand peaks in Q1 and Q4 2025, with stable Q2-Q3. Flexible procurement and manufacturing strategies are recommended.

Other Logic ICs:Moderate demand decline in H1 2025 (Q1-Q2), stabilizing in H2 (Q3-Q4).

Lead Time Trends

Arithmetic circuits:Stable Q1-Q2 lead times, tightening supply in Q3 requiring supplier coordination, with Q4 improvements.

Gate: It's similar to an arithmetic circuit ,Stable Q1-Q2 lead times, tightening supply in Q3, with Q4 improvements.

Other Logic ICs:2025 has a relatively stable lead time throughout the year.

Price Movement Analysis

Arithmetic circuits: Stable pricing in Q1, rising costs Q2-Q3 (secure key materials early), stabilized Q4 pricing for budget control.

Gate: The price trend is to stabilize and then rise, the late cost pressure increases, enterprises need to plan ahead of the procurement budget or look for more cost-effective suppliers.

Other Logic ICs: Favorable buyer market in H1 2025 (Q1-Q2) with price declines, followed by stabilization in H2 requiring market vigilance.

Manufacturer News

Intel:

Next-gen FPGAs: 12-16 weeks lead time

Agilex & Arria V series: 26 weeks (AGI041-based models to reduce to 16 weeks by H1 2025)

Legacy products: Under 26 weeks

STMicroelectronics:

Mainstream MCUs (STM32F/G/L/U/MP): 15 weeks

High-performance (H5/H7): 22 weeks

Automotive-grade (SPC): 40 weeks

Texas Instruments:

Wireless solutions (CC1/CC2/CC3xxx): 6-12 weeks (Wireless Module up to 20 weeks)

MSP430 & TM4C MCUs: 12-18 weeks

DSP (TMS320) & Sitara MPUs: 18 weeks

Monolithic Power Systems (MPS):

Analog power/signal chain/Automotive Grade Products: 26 weeks

Renesas:

Analog/power products: 12-24 weeks

HPC products: Orders can be canceled unilaterally within 90 days

ADI:

Pricing stable with new direct-sales online platform

95% products ship in under 13 weeks

Procurement Recommendations

Resistors: Automotive-grade resistors may face supply constraints in H2 2025, but major manufacturers have already ramped up production plans for thick-film, thin-film, and current-sense products, with significant capacity expansion expected by 2026.

Non-Ceramic Capacitors: Immediate supply shortages and price hikes will hit at the start of the year. Buyers should prioritize securing inventory from suppliers like KEMET in H1 to ensure stable supply.

High-Speed Connectors:Leading connector vendors warn of potential capacity bottlenecks. Avoid short-lead-time orders and instead negotiate long-term contracts to mitigate supply chain risks.

Non-Volatile Memory: Rising demand and component shortages (e.g., controllers and advanced lithography tools) will drive price increases in Q1-Q2. Proactively engage secondary suppliers to secure buffer stock and better pricing.

Volatile Memory: DDR4/DDR5 prices are projected to climb up to 40% by 2025. Buyers should capitalize on short-term spot market opportunities with lower prices and oversupply to lock in inventory.

Programmable Logic:Following Altera's Q4 price adjustments, AMD has raised FPGA prices by 10%-20% across 16nm-90nm nodes, effective mid-December 2024.

Relays: Suppliers like Hongfa, Omron, and Fujitsu are working to hold prices steady, but Panasonic has increased costs for select power, signal, and safety relay series.